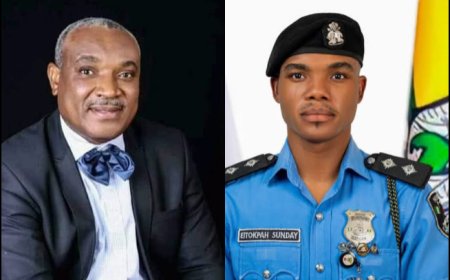

Cross River: Gov. Otu's Aide, Aruku, Clarifies N13,000 Bank Charges on Youth Empowerment Scheme

Bassey BASSEY

The Chairman of the Cross River State Youth Empowerment Scheme, Dr. Kalita Aruku, has clarified the controversy surrounding the N13,000 charge required for applicants seeking access to Bank of Industry (BOI) loans under the scheme.

Aruku explained that the fee is strictly bank processing charges as authorised by the Center Bank of Nigeria,CBN.

Dr. Aruku’s clarification follows reports alleging that the Youth Empowerment Scheme, YES, office was imposing exorbitant charges on applicants to process loan applications.

According to him, the N13,000 charge is required by the bank to enable verification of applicants’ business details with the Corporate Affairs Commission, CAC, to ensure the authenticity of submitted documents.

He stressed that the charge is not imposed by the YES office and has no financial benefit to the scheme or the state government. He added that the Cross River State Government has resolved to refund the amount to applicants whose documentation is confirmed to be genuine.

“The charge is meant to allow the bank verify the authenticity of the companies used by applicants to access the Bank of Industry loan domiciled with Zenith Bank,” Dr. Aruku said.

He explained that the N13,000 is paid into the applicant’s bank account, from which the bank deducts the amount to conduct the necessary CAC search and activate the account.

“However, the state government has agreed to refund the money to successful applicants with legitimate documents as part of its support for youth entrepreneurship,” he added.

Dr. Aruku further noted that the BOI funds domiciled with Zenith Bank are accessible to Cross Riverians with viable business ideas who require start up or expansion capital.

He explained that the state government, through the YES office, is encouraging young entrepreneurs to take advantage of the facility, which comes with a nine percent annual interest rate and a three month moratorium.

THE BEAGLE NEWS