PAYE Tax Reform: FG Plans Relief for 98 Percent of Workers

By Inemesit Friday

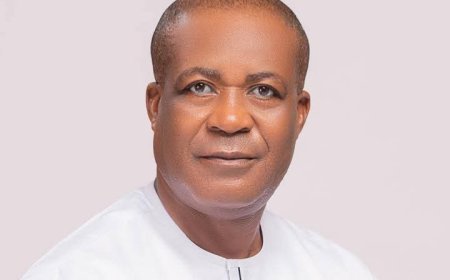

The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, has revealed that about 98 percent of Nigerian workers will be exempted from paying Pay-As-You-Earn (PAYE) tax when the new tax laws take effect from January 2026.

Oyedele made the disclosure while speaking at the ongoing 31st Nigerian Economic Summit (NES31) in Abuja, explaining that the reforms are designed to protect low-income earners and those living near the poverty line, while creating a more equitable and efficient tax system.

“The more inequality you create, the more time bombs you have,” Oyedele said. “These reforms are intended to strengthen governance around revenue generation, improve accountability, and ensure tax revenues are effectively utilised.”

He explained that the reforms, which form part of President Bola Tinubu’s broader fiscal policy agenda, aim to enhance Nigeria’s sovereign credit rating, reduce borrowing costs for both government and businesses, and stimulate private-sector investment.

Oyedele disclosed that the reform process has not been without personal risk, revealing that he had received death threats due to his role in driving the initiative. “Reform is tough,” he said. “I have faced threats, but I am not afraid. I recently celebrated my 50th birthday, and even if anything happens, I have done my part. These reforms belong to Nigerians, not to Mr. President.”

The reforms seek to build a fairer system where wealthy individuals and large corporations contribute more to national development. “If we do not pay our taxes in an orderly manner, we will pay them in a disorderly manner. Over N30 trillion printed in recent years has contributed to inflation and the devaluation of the naira. We do not want to repeat mistakes seen in countries like Zimbabwe, where prices double frequently,” Oyedele said.

Under the new tax structure, poor Nigerians will be exempted from personal income tax, while high-net-worth individuals will pay higher rates. Small and low-income businesses will also benefit from tax exemptions to strengthen their operations and create jobs. “We are considering tax-exempt stickers for nano businesses to protect street vendors, petty traders, and artisans from harassment,” he added.

Oyedele assured that state and local governments, represented through the Joint Tax Board, support the reforms. He explained that the new system will not reduce states’ revenue, but help them earn more from the Federation Account without burdening vulnerable citizens.

He cited recent improvements in national revenue distribution as evidence that fiscal reforms are already yielding results. Oyedele also criticized outdated and regressive taxes such as the so-called “wheelbarrow tax,” and revealed that the committee has submitted ten amendment proposals to the National Assembly to modernize the tax system.

Finally, Oyedele emphasized that expenditure reforms are underway to ensure that tax revenues are used efficiently and transparently, creating a tax system that is simple, fair, and growth-oriented, and that fairly distributes the tax burden across all segments of society.