Akwa Ibom, Oil Rich State With Low Performance Index

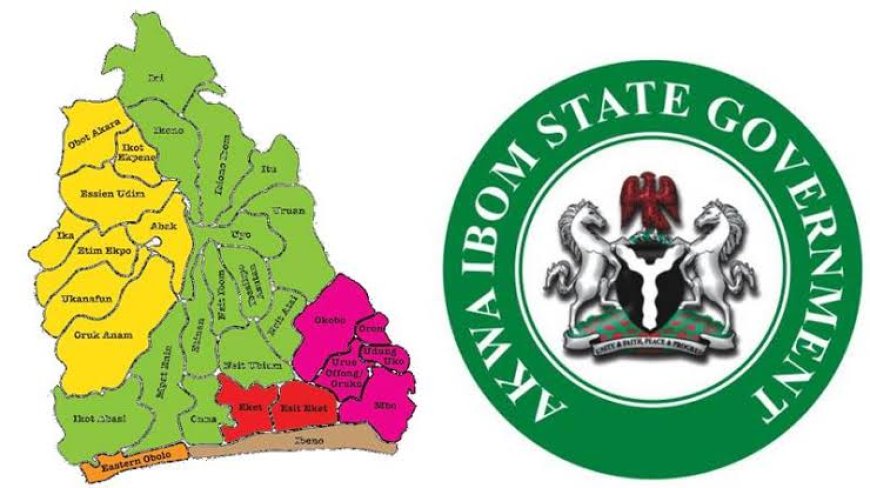

Akwa Ibom is unarguably Nigeria’s richest oil state, with a daily production of 504,000 barrels per day (bpd) as of this year, and receiving a large chunk of the 13 percent oil derivation payout to the nine oil producing states from Federation Accounts Allocation Committee (FAAC). Between January and May this year, the littoral state received N124.79 billion as oil derivation, according to data from the National Bureau of Statistics (NBS).

However, that is how far it positions. Prudent management of the state’s oil wealth has been at best stagnating, keeping its $19.25 billion economy less-sustainable, according to a recent South-South geopolitical zone’s states performance index (pSPI) released by Phillips Consulting. Akwa Ibom ranked 21st, depicting a “state with potential in search of purpose”. Though its investments in infrastructure had produced noticeable projects, however, sustainability has been uncertain. Diversifying its economy away from oil has remained abysmally shallow, with low industrialisation effort, the survey showed.

According to the pSPI, “unless Akwa Ibom pivots decisively toward education, technology, and agro-industrial growth, it risks sliding further down the index. Its people, energetic and creative, deserve better than the complacency that oil wealth has fostered. The gap between potential and performance is wide, and widening still”.

On the other hand, Cross River, a neighbouring state, sacked from the littoral oil states’ list by the ICJ (in 2002) and Supreme Court (in 2008), fared better, emerging the South-South zone’s best performer in the pSPI. The state, with a subnational GDP in excess of $10.08 billion, ranked 14th, showing flashes of reform. Its tourism sector is being revived, fiscal management to some extent improved, and citizen perception also showed a touch. However the state still struggles with low industrial depth and weak rural infrastructure. Till date, the unfulfilled promise of $650 million Tinapa business and leisure complex lingers, an ambition without execution. Cross River, according to pSPI is “alive with ideas, experimenting with innovation, but constrained by size and internal contradictions. Its leaders appear aware of the possibilities but often lack the resources or political will to make them enduring”. The pSPI tallies indicate “a state that is competent but cautious, reform-minded but not transformative”.

Edo follows in 16th, Delta in 17th, Rivers in 25th position, and Bayelsa leads from the bottom at 29th. It was described as a state with “wealth without transformation”.

For Rivers, with the second highest subnational GDP after Lagos, the Phillips Consulting pSPI described it as a state that “should be a national powerhouse”. Its capital, Port Harcourt, the so-called “Garden City,” hosts Nigeria’s oil and gas industries, international companies, and maritime assets. “Yet the state is marked by infrastructural decay, erratic services, and declining trust. It resembles Weimar Berlin — bustling and cosmopolitan, yet weakened by volatility and fragile institutions. Governance appears reactive, shaped by cycles of elite contestation rather than long-term planning. For a state with such strategic assets, mediocrity is inexcusable. The pSPI captures a state weighed down by underachievement and squandered potential”.

The pSPI concluded that none of the positions matches the South-South region’s potential or its revenue profile. “Instead, the region has become a classic example of the “resource curse” — where abundance of natural wealth creates complacency, weakens institutions, and discourages innovation. When judged by the cold data of the pSPI, the South-South is exposed as a region long on wealth but short on progress,” the survey added.

SOURCE : BUSINESSVILE