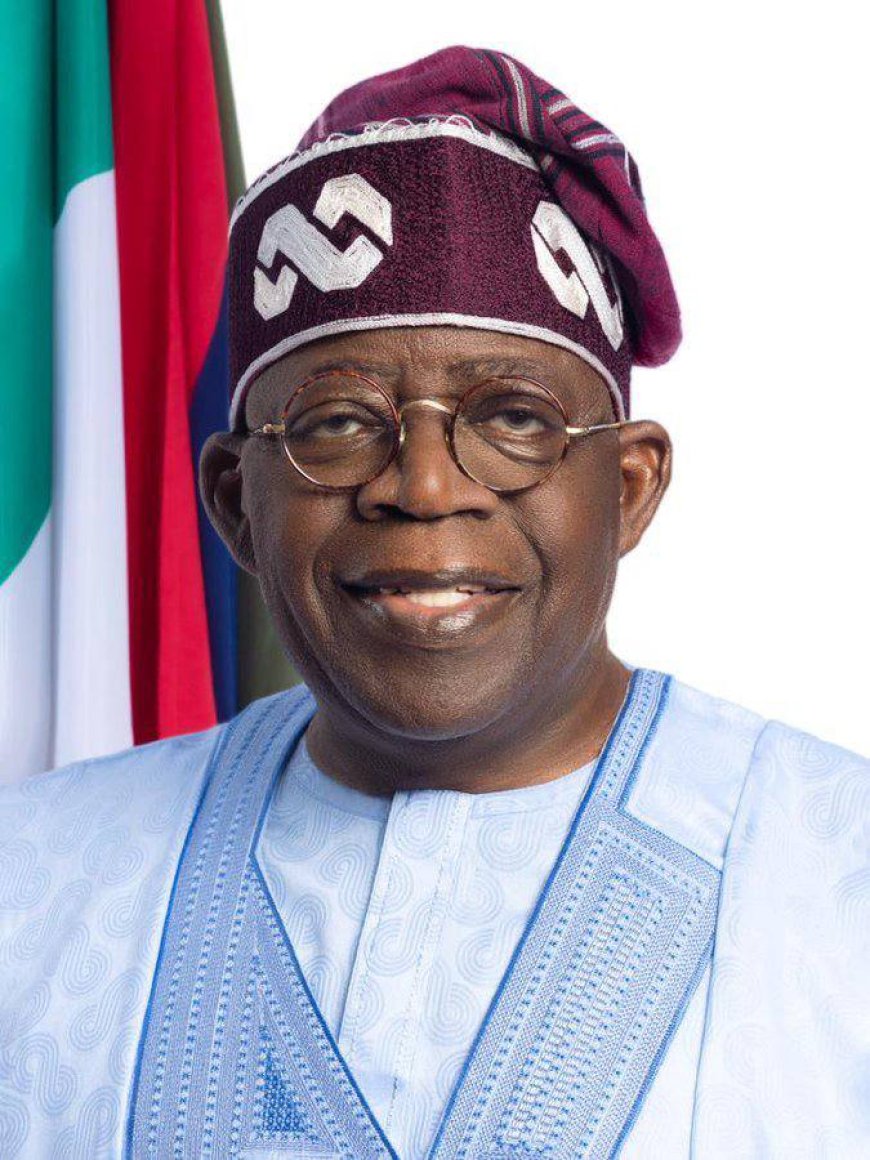

NO GOING BACK ON TAX REFORMS, TINUBU TELLS NORTHERN GOVERNORS

By Our Reporter

President Bola Tinubu has stated unequivocally that there is no going back on the new tax reforms bill before the National Assembly.

Tinubu, who stated this during a media chat with selected journalists said that Nigeria "can't continue in the old ways."

He said: "Tax reform is here to stay. We cannot just continue to do what we were doing yesteryears in today's economy. We cannot retool this economy with old thoughts.

"I believe I have that capacity, I believe so that is why I went into the race. I am focused, let's all focus on what Nigeria needs and what I am supposed to do for Nigerians.

"It's just not going to be Eldorado for everybody. But a new dawn is here and I am convinced and you should be convinced, you should help propagate that conviction."

This proposed legislation aims among other things to overhaul the country's tax collection and administration systems, presenting an opportunity to create another taxation model.

Some of the highlights of the bill include radical provisions, such as revisions to the Value Added Tax (VAT) revenue-sharing formula and exemptions for small businesses and the average Nigerians.

One of the issues under contentious in the reform is the proposed VAT revenue-sharing formula. Under the new arrangement, 60% of VAT revenue will be allocated to the state where goods and services were consumed, 20% distributed based on population, and the remaining 20% equally shared among all states.

This marks a departure from the current system, where revenue is distributed based on where companies remit taxes, often in states with a high concentration of corporate headquarters like Lagos and Rivers.

The new model aims to ensure fairness as it emphasises consumption patterns. This new arrangement has attracted scathing criticisms from from northern state governors and some critical stakeholders who feel disadvantaged.

The governors are against the derivation-based model, which they claim shifts a larger share of the revenue to southern states.

The bills before the NASS are a proposal to establish the Joint Revenue Board, the Tax Appeal Tribunal, and the Office of the Tax Ombudsman.